Wealth tax1 is stupid, it really is. For those keeping score, let’s list the reasons…

It drives our most successful startup entreprenuers out of the country

What happens when your most successful startup founders are expected to pay taxes several multiples of salary on frozen and unrealized value? They have to leave

This loss of talent and capital is effectively a one-way-door, which has long term negative effects on job creation and entrepreneurship in the economy.

It destroys value in SME’s with capital intensive businesses

What happens when small owners in local businesses must take massive dividends (with associated taxes) in order to pay an additional tax? Employment in rural areas suffers

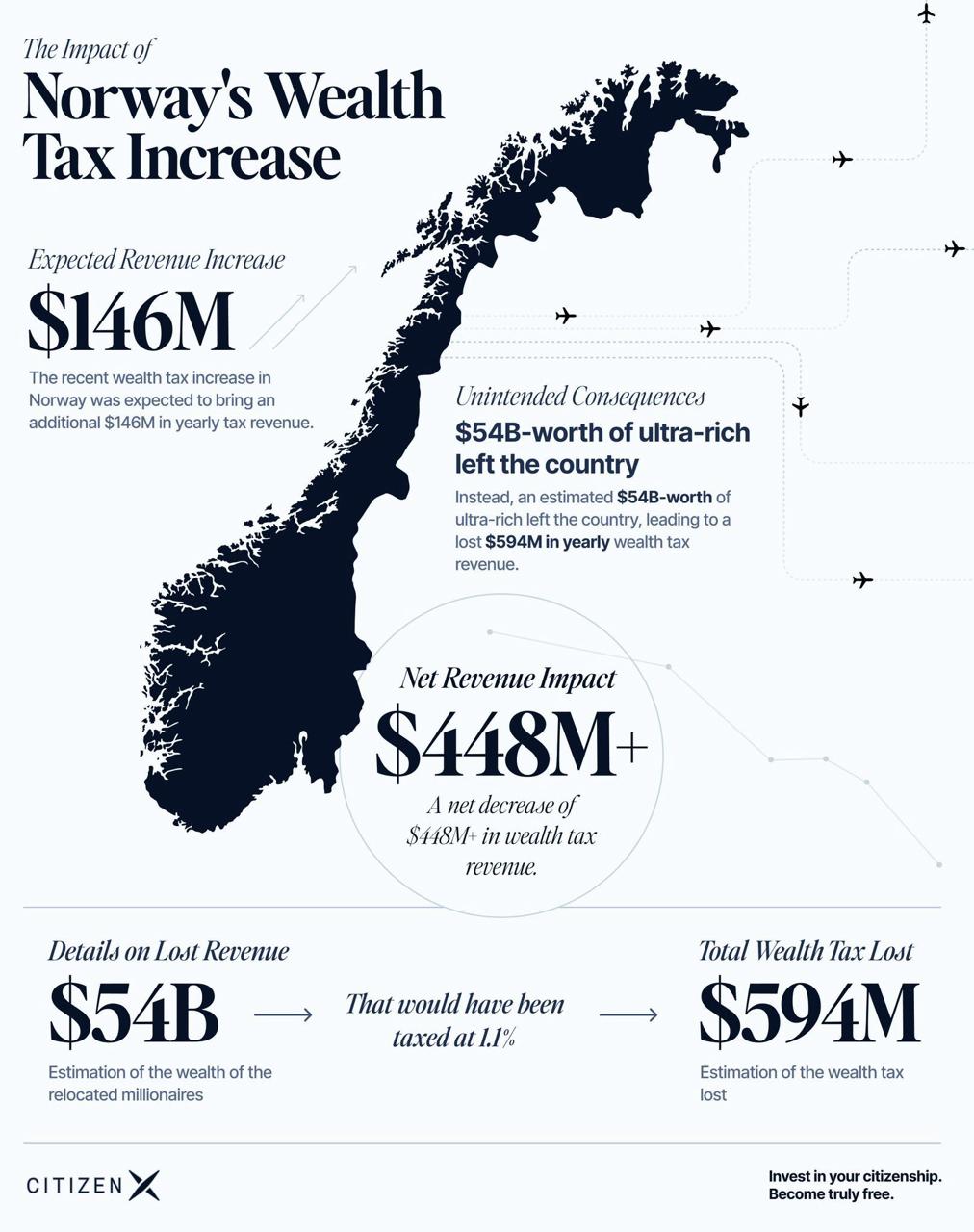

It reduces tax revenues

What happens when all the expected income not only doesn’t materialize, but overall tax is reduced due to capital flight? Ordinary non-wealthy citizens have to pick up the bill:

source: https://citizenx.com/insights/norway-wealth-exodus/

source: https://citizenx.com/insights/norway-wealth-exodus/

German research shows it would be damaging to the economy

The results of the study suggest that the introduction of a wealth tax in Germany would lead to a substantial drop in employment, investments, savings and overall economic growth – even given favoured tax rates on corporate wealth and high tax exemption levels. This is due to the fact that a wealth tax would dilute incentives for firms to invest and accumulate capital, which would, in turn, reduce the economy’s production capacities. The effect would be particularly strong among foreign investors who would probably withdraw their invested capital in response to the tax. The model simulations suggest that the introduction of a wealth tax would dampen the annual growth rate of the economy by 0.3 to 0.35 percentage points within the first eight years of its launch depending on the specific design of the tax.

The analysis also shows that a wealth tax would not pay off in fiscal terms, as the higher annual revenues from the wealth tax of around 14 billion euros would be more than offset by declining tax returns from other sources amounting to over 40 billion euros.

source: https://www.ifo.de/en/project/2017-03-01/economic-evaluation-different-wealth-tax-concepts

French analysis shows it leads to higher tax burdens for the non-wealthy

The ISF causes an annual fiscal shortfall of €7 billion, or about twice what it yields; The ISF wealth tax has probably reduced GDP growth by 0.2% per annum, or around 3.5 billion (roughly the same as it yields); In an open world, the ISF wealth tax impoverishes France, shifting the tax burden from wealthy taxpayers leaving the country onto other taxpayers.

source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1268381

It transfers ownership to foreign interests

You know who doesn’t have to pay wealth taxes? Foreign non-domicile owners…. So guess who will buy up the stakes in companies that founders have to sell to pay their tax…

Here’s the tl;dr: Norway has instituted a wealth tax. This led a lot of wealthy folks to leave the country. To stop this, Norway has instututed an exit tax. Now, these laws are having real negative effects on startup founders who have paper wealth, zero liquidity, and are now trapped from growing their businesses internationally. ↩︎